Luxury holidays and smashed avo; live a life without limits through the power of saving!

Money seems to be the be-all-and-end-all to life. Everything has a price tag. Unfortunately, how much you have in your bank account can determine how you live life and, sometimes, we run into the roadblock of being priced out of that special something; whether it is your dream holiday, that set of designer clothes, tickets to a music festival with your favourite band headlining, or simply being able to venture out for nights on the town as often as you’d like.

The reality is you can avoid these roadblocks more often than not. You are in control. While the figure in our bank accounts may have the final say on how we live, most people grossly underestimate how much a few simple adjustments and tweaks to their lifestyle can have on that figure. How you are spending the money in your account is just as important as how much you are earning.

Do you really want that vacation to the Bahamas? Want to pay off your mortgage in five years instead of ten? Want to go to all music festivals year round? Be prepared to earn it. Make the necessary steps in order to strive towards it. Routine budgeting is a surefire way to achieving your goals. Figure out how to save your money, lessen all unnecessary expenditures and open up additional sources of revenue. That way, you’ll be on the road to the lifestyle of your dreams.

Begin by building a spreadsheet. By pulling together your financial information, you’ll have a clear image on how you’re currently spending. This will let you devise a plan for future budgeting. For a period of three months, record all of your transactions and class them into the following categories.

Income

This is the combination of wages, trust distributions, dividends, Centrelink payments or any other event where money is put into your bank account.

Expenses

This is all instances of money being taken out of your account. For the sake of easier budgeting, we suggest that you subclass each expense into the following categories:

- Insurance: Group all insurance payments for anything into this category.

- Housing: Rent, board or mortgage repayments. Essentially, any dollars that is put towards keeping a roof over your head.

- Transportation: the money that gets you from place to place, either by being spent on petrol, uber trips or public transportation fare.

- Groceries: food, drink, toiletries, household supplies and any other product that is bought regularly for your household.

- Utilities: bills for gas, electricity, water, internet. Often paid once every two or three months.

- Medical: medication costs (deductibles included), appointments and any other related expense bar insurance.

- Child related: child support, school fees & uniform, fees for extracurricular events and anything related to your child’s welfare.

- Car related: servicing and registration expenses but not petrol nor insurance.

Once you have tallied your income and expenses, figure out if you’re in a deficit or a surplus. If the total of your expenses is larger than your income, you’re in a deficit. The good news is that you can rectify it with better budgeting tactics. Conversely, if your income is higher than the total of your expenses, you’re in a surplus… but your surplus may not be great enough to achieve your goals, ergo you may also benefit from better budgeting.

How does someone “budget better”? The next clear step would be to cut out excess spending in your lifestyle, easily accomplished by carpooling your way to work, or reducing your energy usage (green lightbulbs). Obvious solutions will only go so far, the less obvious (but more effective) is to regulate your cashflow. Check out some tips here: https://pursuewealth.com.au/here-are-25-penny-pinching-ideas-without-being-a-tight-ass/

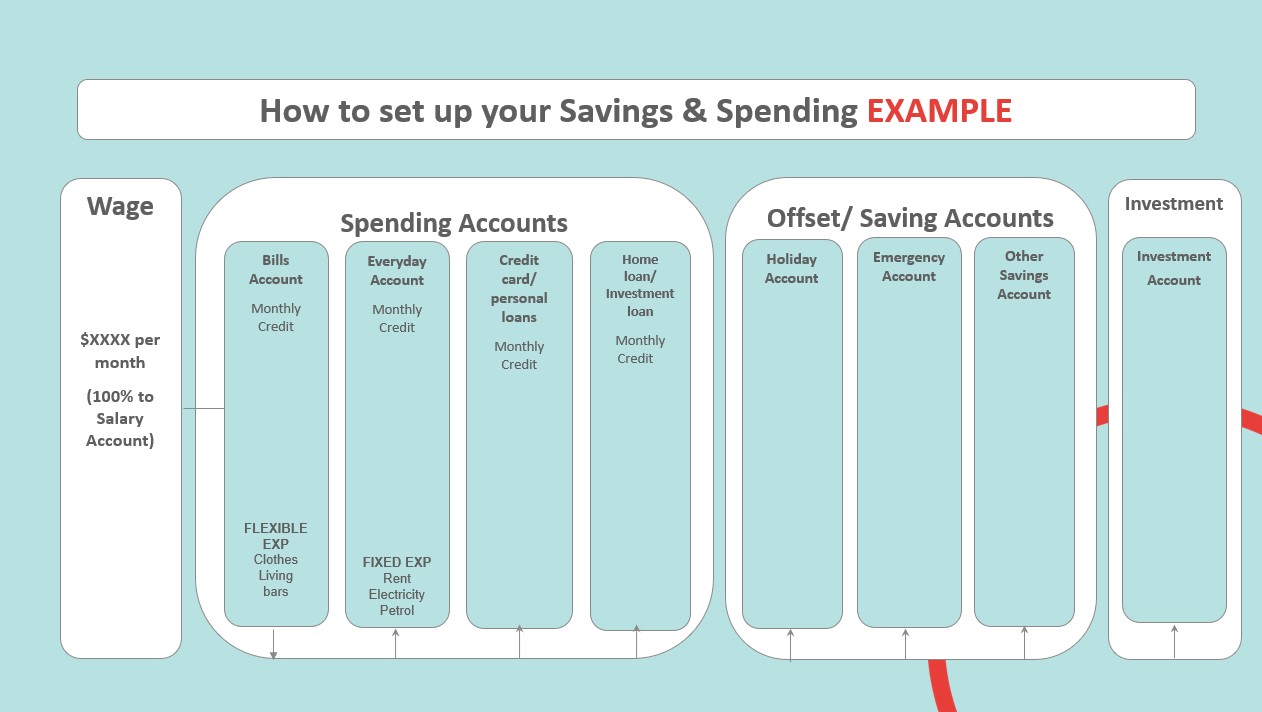

We advise our members to further regulate their use of money by budget bucketing. To bucket a budget, you simply have to separate savings into “buckets” (pools) for your different expenses. If all your earnings are cash-in-hand, you may do this literally. Otherwise, check with your bank about setting up additional savings accounts. Having buckets spread across multiple banks can quash the temptation to dip into your bank accounts and name these accounts related to what they are to be used for, i.e. Fiji Holiday.

How many buckets should I have? Although most people’s situations financial situations are different, we advise most of our clients to split their buckets between savings, spending and investment accounts.

Spending Buckets

Ideally, money should flow out of this account and into other accounts if all your current needs are being met. You can further subdivide this account into four accounts:

- Bills Account Bucket

This is a flexible expense account. You would use this account to cover most lifestyle expenses such as clothes, bars, getting food while out and other discretionary purchases.

- Everyday Account Bucket

This is for the fixed expense bucket, rent, electricity and petrol. The set nature of this account makes it easy to.

- Credit card/personal loans Bucket

For all loans, including credit card balances and loans for things such as cars. Ideally this account shrinks over the course of your budgeting.

- Home loans/investment loan

For mortgage repayments owed for your home or investment property.

Offset/Savings

- Emergency Account Bucket

A rainy day fund for emergency needs, such as car replacement or unemployment. Of the savings buckets, you should consider this to be the foremost bucket and fill it as soon as possible. The cap on this bucket should be approximately three months’ worth of expenses. - Holiday Account Bucket

This lets you set aside money for the grand holiday you want. This will vary from person to person due to different ideas on what constitutes a great holiday.

- Other Savings Account Bucket

This is for all other saving concerns that you need, including tax offsets or luxuries such as a dream car or boat.

Investment Bucket

- Investment Account Bucket

For revenues generated from investments. This is the longest of long-term account that can grow into something large, such as a home loan or additional funds for your retirement.

See above for an example banking structure

See above for an example banking structure

Bucketing will let become a master saver. Once you are in the habit of bucketing, you should begin to see how you can save extra, often by cutting unnecessary expenses. Additionally, you’ll have financial peace of mind. By “filling” the buckets, one can rest easy knowing that they shan’t be caught penniless at the wrong time.

You may come to find saving alone may not to be enough. To that end, you may consider expanding your income to get where you want to be.

Working a side hustle can rake in the extra cash you need to live life. So long as you have a little bit of time, you can start to make money on the side. The internet has a lot on offer for those needing to expand their income.

Want to sell your used goods? Amazon, eBay and Facebook Marketplace have made clearing out your wardrobe and offloading old belongings a valuable venture. But did you know that you can lease your belongings just as easily. Own a car? Lend it out online through carnextdoor.com.au. Have a room to spare and a flair for hosting people? Accommodate a variety of people through AirBnB or its various competitors. Even your garage or parking space can be put up for rent on sites such as spacer.com.au.

Hobbies, talents or mere passions can also be cashed in on. People don’t need to own anything rentable to create a stream of supplementary income; just turn your hobby into a side hustle is relatively easy. Love dabbling in arts and crafts? Use niche e-commerce to sell your wares such as Etsy. Good at photography? Consider taking stock photos for online brokers such as Getty Images. Have a burning desire to interact with other cultures? You can teach English online by earning a TESOL certificate, a credential which is easily acquired by native speakers and can open the door to many casual teaching jobs which can supplement your income.

Even if you think none of your interests are cashable, your time is just as valuable. Crowdsourcing platforms allow people to trade in their time for money. Platforms such as Appen or Amazon’s Mechanical Turk allow you to complete simple HIT (human intelligence tasks) for many different applications, ranging from the development of artificial intelligence to the finding of missing persons. The pay for these tasks can be as low as a few cents, but can be completed within seconds and are sometimes fun. Although your pay may only total to a few dollars per hour, you set your own hours and are power through these in your PJs from home.

As in life, the things we struggle for are the most rewarding. It is far better to achieve a lifestyle you’re happy with rather than slinking into one that you aren’t happy with. Our advisers are available to people who want to march their way to success. Contact us! We would love to hear from you: https://pursuewealth.com.au/chat/

Use our worksheet to keep track of your personal spending and become your own master of saving!

Enter your name and email address so we can drop your worksheet straight into your inbox today