Compare, Compromise & Consolidate: The Three C’s of Superannuation

Wrinkles, grey hair and tiredness… these are the things that young Australians worry about when we discuss age. It’s not a pleasant topic. We certainly think about how we will look and feel twenty years from now, but we often fail to think about how we will brace ourselves for the tide of aging.

It’s never too early to think about Superannuation

Young Australians and concern over superannuation are like oil and water. They don’t mix. This needs to change. Australia is becoming older, not younger. For the past twenty years, we have seen life expectancies increase and as a such, our median age has steadily risen. As at the end of 2018, 1 in every 7 Australians is over the age of 65.

Superannuation is thusly more important than ever. Progressively, both the government and the media place more and more emphasis on the importance of superannuation with each passing day. The contribution rate made out of your income and into superannuation is set to increase from 9.5% of employer contributions to 12% by 2025. While there will always be some political back-and-forth over it, it is clear that superannuation is set to totally replace pensions.

Act now.

No matter how old you are, you’re more than likely to reach retirement age. Having ignored your Super in your youth will not be a regret you want to have, especially when you’re grey-haired, wrinkled and too tired to work another 15 years. An awesome plan incorporating your super will let you live more comfortably than you are now in your working days. Beyond that, your super can protect you in event of severe financial hardship, terminal illness or if you are rendered unable to work. They are too important to put off no matter how young you are.

Related post: Super Splitting for the New-Aged Couple

Superannuation break-down: Our Triple-C Model

Pursue Wealth’s approach to superannuation is super easy to follow. It can be difficult to make the first step. We understand that the financial jargon and concepts that underpin Superannuation, so we break it down into our Triple C model: Compare, Choose and Consolidate.

Compare

We sift through and research superfunds. Start with any that you are already party to and then search for others. There are five major issues that need to be explored when choosing a superfund: fees, performance, investment options, insurance and other benefits. These are discussed below.

Choose

We select a superannuation that is perfect for you. You will need to consider where you are in life. It is crucial that you choose a superfund that matches your position in life, especially taking into consideration how much you are earning, how much you intend to earn in the near future, how close you are to retirement age and what are the investment options available. Additionally, do you have a life insurance policy? Do you have any significant post-retirement plans (i.e. travel)? Could you access super earlier than usual? These are all things needed to be considered when choosing a superfund.

Consolidate

Now that you have chosen your superfund, tidy up loose ends by merging your supers into that super. Having only one super will save costs from fees and simply make it easier to manage. Annoyingly, it’s easy to unknowingly accumulate a coterie of different Superfunds through the changing of jobs. But it is just as easy to consolidate these funds. Note, sometimes there are very good reasons not to consolidate so it can be ideal for you not to have only one super fund.

So, how do we compare superannuation funds?

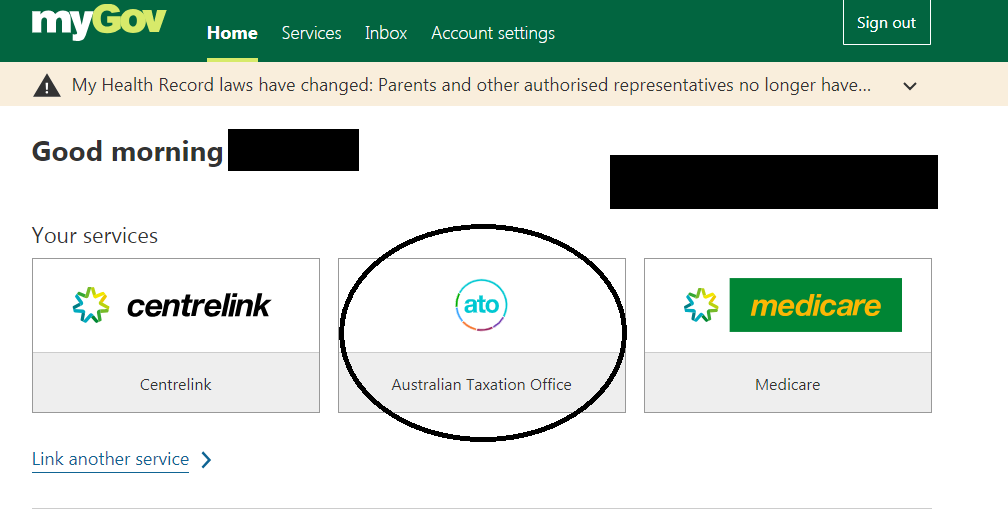

Start by creating an account on my.gov.au and link it to your ATO account. Not only does this platform provide you with the details of superfunds you are already a member of, it can enable you to consolidate your superfund with no more than a few mouse clicks (this doesn’t always work but can be great if it does).

To find prospective super funds, we run a comparison through our special financial adviser software. You can check websites, such as Canstar, but they won’t allow you to look at all different investment options which will make this like comparing apples with oranges. If you want a deeper analysis of your Superfund, read the Product Disclosure Statement (PDS). Almost all major superannuation providers will leave a PDF on their websites for public viewing, easily found by searching “[superannuation name] PDS” via Google.

Understanding the PDS

Generally, the PDS contains a table or subsection that delineates the super’s fees. The usual suspects are:

Investment Fees

An annual payment of less than 1% of your superannuation, paid for the costs of managing your super’s investment.

Administration Fees

A weekly payment of less than a few dollars, paid to cover the cost of operating your superfund or a % of the balance.

Rollover & Exit Fees

As the 1st July 2019 exit fees have been abolished so these are no longer applicable.

Buy/Sell Spread

Systemic fees that are paid to cover transaction costs when investments.

Consultation Fees

Your superfund provider may charge you advice fees for direct consultations. These won’t be found in the PDS so check with your provider.

Investment Options

Investment options are definitely an item that you must consider. Rather than money being a limiting factor, time is the main concern when choosing an investment option. Simply put, the more time between now and retirement means the more risk you can (safely) assume. Here are three common investment options that are offered by most providers:

Growth

~85% invested into shares and property. These are the riskier run of super options. You should only be selecting this if you have more than a decade between you and retirement. This will grant you enough time to safely weather the highs & lows of the market, ultimately delivering a higher net return

Balance

Ranging from 50% to 70% invested into shares and property. A middle ground between the options above.

Conservative

~30% invested into shares and property. The safer choice. Those with less time between now and when they wish to retire will need to secure the money they already have, rather than risk losing it to market volatility.

What about life insurance?

Life insurance is also a key feature in the hunt for the right superfund. Many Superannuation providers avail to their members a cheap life insurance policy as an elective to their superfund; deducting premiums from your retirement fund. They can do this as they buy life insurance policies in bulk. Other benefits include your premiums being automatically deducted as well as (sometimes) health checks being no longer required. Just before you opt for a life insurance via superfund, there are several limitations you need to consider…

Ends with retirement

Cover is likely timed to end when the superfund is no longer being paid into (i.e. you retire). Although many good life insurance policies have an expiration age, they typically expire once the insured nears the age of 100. If you wish to resume your life insurance after you retire, note that you will have to find a policy provider willing to offer a life insurance policy to the elderly.

Inflexible

As it is attached to a superfund, you may not be able to move policy from one superfund to another when consolidating. Your cover may as well end indefinitely if your account balance dips below a certain threshold or if your employer’s contribution suddenly come to a halt.

Lack of a death nomination

Unless your superfund provides you with binding beneficiary nominations (people who receive your super in the case of your death), you won’t be able to declare who specifically will receive your life insurance benefits. Speaking of which, you should set your beneficiary nominations for your superfund ASAP if they are available.

Limits

Your cover can be both restricted in amount and type of coverage you will receive, all depending on your superfund’s life insurance policy. Good policies will allow huge limits so this shouldn’t restrict you.

Underwriting

You could possibly get automatic insurance with your super fund, but this can have ‘pre-existing exclusions’ with it which means you might be paying for insurance that you can’t claim on. It thus might be worth going through ‘health questions’ or ‘underwriting’ to allow the insurer to examine your health status to ensure they will cover you.

Don’t wait till it’s too late to think about superannuation

Your current attitude towards your superfund will shape your future. Much more than greyed hair or a walking frame ever could. Young Australians find having a lengthy conversation about superannuation to be a rare, if not, impossible occurrence in their daily lives. Ergo, those with an intimate understanding of superannuation need to bridge the gap of knowledge between the young people and super. Please don’t let a lack of knowledge keep you from the necessary taking action right now.

Related video: Super beneficiaries… who knew they were so confusing!