How Global Events Affect the Stock Market

Whether you are a seasoned investor or have only started dipping your toes in the share market, it is helpful to understand how significant world and economic events impact your investment portfolio.

At Pursue Wealth, we believe in the power of knowledge and aim to educate our members to make informed financial decisions. However, we know the world of finance can be confusing and overcomplicated sometimes, which is a huge barrier for current investors wanting to learn more, and for people who want to use this opportunity to begin investing.

As such, today we will be sharing our own simplified guide on the share market and how to go about investing and managing your portfolio during times of economic uncertainty.

The Foundation

Beyond knowing that shares represent part ownership of a company, it’s important you also understand the factors that might push the value of your equity up or down. At its core, share prices are driven by demand and supply. When there are lots of buyers in the market for the shares you hold (increased demand), the price will increase. In contrast, when lots of people are looking to sell the shares you hold (increased supply), the price will decrease.

There are numerous factors that can influence this volatility, and these are divided into two main categories – risks you can control, and risks you cannot control. For example, a new CEO of a public company is often news that will sway the price of that specific company’s shares. Depending on if the price increases (excess demand) or decreases (excess supply), you can tell what the market (public) thinks about this piece of new information. Company-specific risks are typically controlled by ensuring that you do not have “all your eggs in one basket”, and instead, have shareholdings in other companies as well. If bad news strikes for one company, the rest of your portfolio should theoretically hold its value, or ideally, increase to counteract the downturn.

Risks that cannot be controlled with diversification are called “systematic / market risk” because they affect the entire market, not just a specific company or industry, and are generally unpredictable. This is usually linked to unfortunate global events such as war, natural disasters, and what we have been experiencing as of late, a pandemic. The impact of these events vary greatly with each phenomenon, however, the results can be rather extreme. For example, between the peak on the 20th February 2020 and the crash on 16th March 2020, Australia’s share market has seen a fall of 30.2% which offset the market gains from 2019.

Circling back to our lesson on demand and supply – you can conclude from this example that the ASX rapidly dropped due to increased supply as people fled share market in search for more ‘safe’ assets such as cash or gold. During times of uncertainty, this effect is prevalent because shares are considered a “growth” asset that is expected to yield high returns with the trade-off being high risk; however, most investors are risk-averse by human nature and will start opting for “conservative” assets in an attempt to preserve their capital.

This effect has been exacerbated in today’s society, with media playing a heavy role in fuelling people’s emotional decision making. When investors fall into the trap of “herd mentality” they risk major losses by selling shares at the same time as everyone else. Consequently, funds that have been moved to more defensive asset classes, will face an additional issue of re-entering the market before prices increase again. This outcome goes against the golden rule of “buying low, and selling high”.

However, we understand it’s uncomfortable to sit and do nothing when you can see the value of your portfolio fluctuating wildly. That’s why we urge our members to look at the big picture. Ask yourself, what are you investing for? Do you genuinely need these funds now? If you’re in it for the long haul and you have a robust investment strategy in place, it may be in your best interest to stay and ride out the wave*.

*speak to your financial adviser about your specific needs

Historical Market Movements

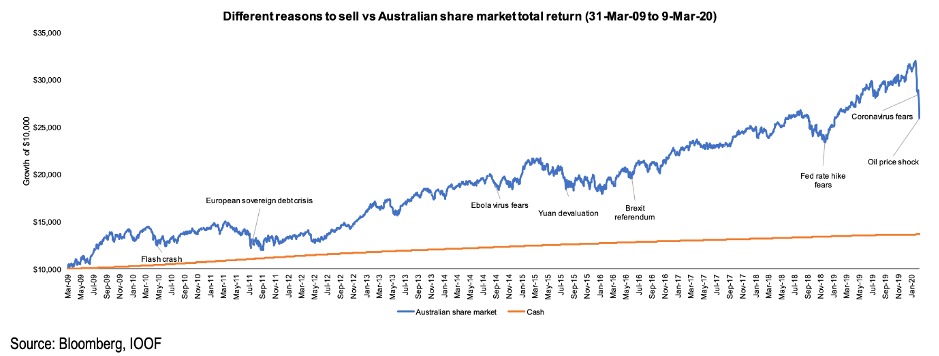

To help you see the big picture, we have found it useful to look back on past global events and analyse the impact these events had on price movements over a longer period of time.

The above graph represents the hypothetical growth of $10,000 when invested in the Australian share market (blue line) between March 2009 to March 2020, compared to leaving this money in cash (orange line).

Along the blue line, there are signposts for global economic and social events that may have been reasons for investors to sell out of shares. Although there has been some volatility, it is undeniable that the market has recovered and grown over time. Since the global financial crisis (2008), investors had the opportunity to double their money (earn 159.7%) if they maintained their position in the share market. In contrast, investors that panicked and moved to cash would only have an earning capacity of 36.5% over the last 11 years.

Remember the saying: Time in the market, not timing the market!

Risk Profile

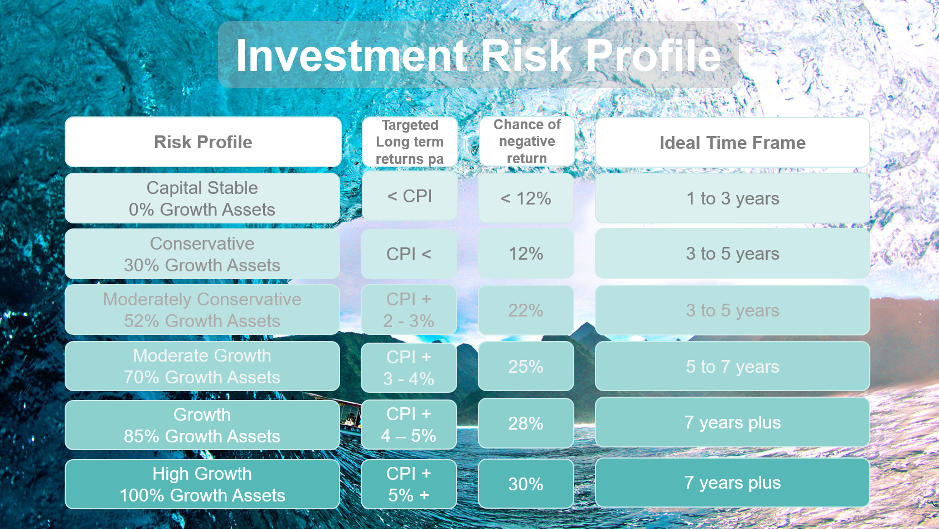

Another helpful exercise to do during this time is to better understand your Risk Profile. A Risk Profile asks a series of questions in relation to your experience with investing, tolerance levels for risk, and investment time frame, to help determine what level of risk you should take on with your investment portfolio. This can range from a conservative portfolio, all the way to a high growth portfolio, and will correspond with an appropriate mix of growth to defensive asset ratio.

Typically, more experienced investors, with long (10+ years) investment time frames, and more aggressive investment preferences will result in a more ‘high growth’ risk profile. Meanwhile, less experienced investors, with shorter (<5 years) investment time frames, and a preference for less volatility, will result in a more ‘conservative’ risk profile.

It is useful to understand this because it helps you manage expectations for your investment portfolio. If you consider yourself a ‘high growth’ investor, you should be comfortable with fluctuations in the market and even see these downturns as opportunities for growth.

At Pursue Wealth, our member’s investment portfolios are determined with risk in mind. They have gone through a detailed strategic asset allocation process to maximise the expected return, subject to varying levels of risk tolerance. This involves modelling different scenarios including times when the share market falls. As such, market volatility arising from global events should be monitored, however, it should not trigger a reactive response that alters your long term investment strategy.

Actions you can take

- Do not panic! It’s easy to get absorbed in hourly news updates, and even more tempting to do what everyone else seems to be doing, however, emotional investment decisions tend to be counterproductive. In these moments, revisit your purpose for investing and the time frame you have set to achieve your goals.

- Maintain a long-term strategy and outlook. All working Australians have investments within their superannuation, and many have personal investment portfolios to work towards goals such as buying a home or achieving financial freedom. Often this means you have no immediate use for your invested funds. As we have seen with historical market movements, investors that held their ground during volatile periods enjoyed higher returns once the market had recovered its losses.

- Amidst the crazy reports of impending doom and crashing share markets, investors forget about the massive opportunity that exists for those that are ready! While the demand for shares is low, you can choose to enter the market at discounted prices and benefit from capital growth over the next few years. Similarly, if you are already invested in more conservative assets, this may be a good time for you to consider if you are willing to increase your risk tolerance. As with any investment decision, however, we prompt you to undertake the necessary research, seek financial advice and ensure this decision contributes to a longer-term strategy without compromising your liquidity.

If you are hungry to learn more about investing or have further questions about the impact of global events on the share market, book in for a 15-minute phone chat with our advisers, here. Speaking to our friendly and professional team may give you the objective opinion you need to guide you in the right direction.